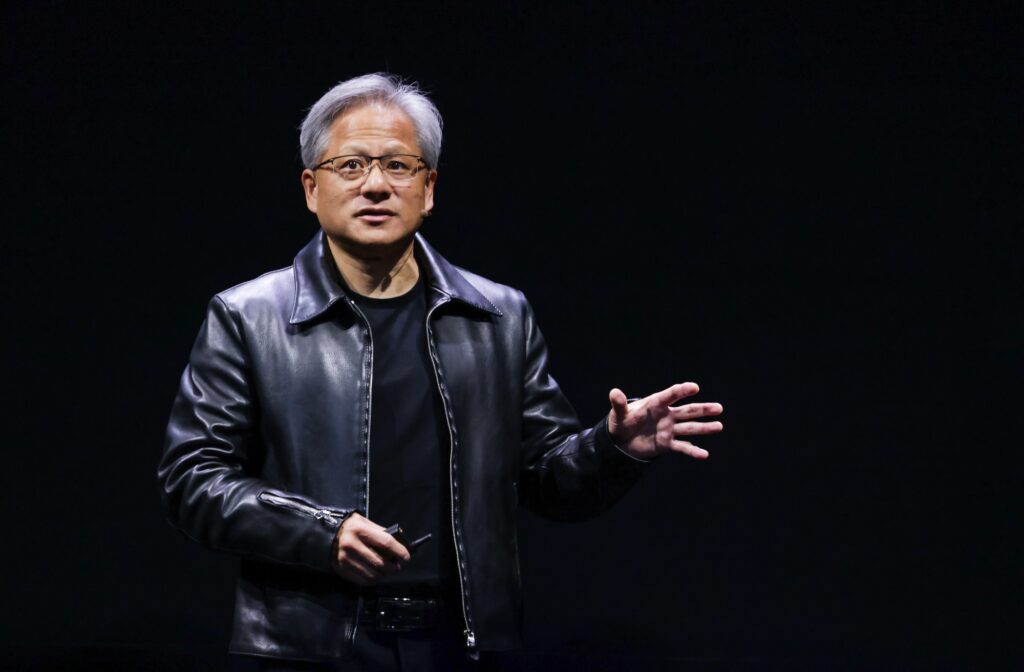

Though it was for a short while, Nvidia’s market valuation of $1.83 trillion, with shares above $740, exceeded that of Amazon and Google.

By contrast, Amazon had $1.8 trillion in value at the time, while Alphabet, the parent company of Google, had roughly $1.82 trillion. The last time Nvidia was more valuable than Amazon was in 2002 when they were each worth under $6 billion.

When the trading was over, Nvidia fell short of the other two tech rivals, but the fact that it could rise so much was incredible, considering that its valuation was only $300 billion in October 2022.

GPUs like the H100 raked in massive profits for Nvidia last year. With sales exceeding 900 tonnes in a single quarter, this immediately increased the company’s profit margins since it reportedly earns 1000% in profits on each unit sold.

At present, Nvidia’s market capitalization stands at $1.784 trillion, Amazon’s at $1.790 trillion, and Google’s (Alphabet) at $1.841 trillion. Nvidia’s AI department has the largest impact on its worth.

The company makes semiconductor chips that enable generative AI, a sector that is currently quite profitable. As per Forbes, the stock of the firm has gained 17,000% in the last ten years.

A ten-year-old $1,000 Nvidia investment would now be valued at almost $175,000. Nvidia is now the fourth most-valued public business, following behind Apple, Microsoft, and Saudi Aramco, respectively.

It is currently the most well-known manufacturer of the semiconductor chip technology underlying generative artificial intelligence. Investors are thrilled by Nvidia’s already skyrocketing performance, as well as the company’s ability to profit from the expanding interest in artificial intelligence.

The improvement in Nvidia’s stock performance demonstrates how the excitement surrounding AI is driving up stock values. The AI systems that drive ChatGPTs and Geminis around the world are powered by the company’s semiconductors with no end in sight.

Artificial Intelligence has a bright future, and AMD also seems interested in playing a significant role in this quickly expanding industry. With its stock price rising recently and an enhanced revenue estimate for 2024, AMD is establishing itself as a serious player in the AI space.

To accommodate this increased demand, AMD is now rapidly growing its supply chain. This demonstrates its dedication to maintaining the lead in the cutthroat AI industry and profiting from its increasing success.

While Nvidia dominates 70% of the market for AI accelerators, AMD may be able to increase its market share by utilizing its GPU as a Service business model. For AMD, this might be a game-changer and help it catch up to Nvidia.

Thank you! Please share your positive feedback. 🔋

How could we improve this post? Please Help us. 😔

[News Reporter]

Malik Usman is student of Computer Science focused on using his knowledge to produce detailed and informative articles covering the latest findings from the tech industry. His expertise allows him to cover subjects like processors, graphics cards, and more. In addition to the latest hardware, Malik can be found writing about the gaming industry from time to time. He is fond of games like God of War, and his work has been mentioned on websites like Whatculture, VG247, IGN, and Eurogamer.