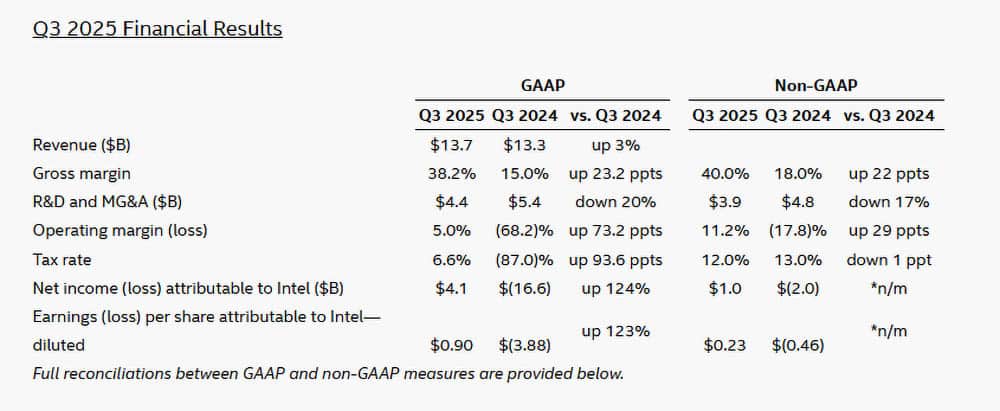

- Intel’s Q3 2025 financial report showed an unexpected recovery, with revenue rising 3% year over year to $13.7 billion.

- The company achieved a $4.1 billion net profit, reversing a $16.6 billion loss from the same quarter last year.

- Intel expects to earn $12.8 to $13.8 billion in revenue in Q4 2025.

Intel began in the 1970s as the company that first launched commercial computer processors, a groundbreaking move that established its position as a major player. But then AMD came in and become an strong competitor. Since then, Intel has been rapidly losing market share, resulting in reduced sales and higher losses. Following a string of poor years, Intel’s newest Q3 2025 financial reports are startling, with revenues increasing for the first time.

When AMD introduced its Ryzen, Ryzen Threadripper, and EPYC processors, Intel had to improve after watching its opponent catch up. After being limited to four cores for so long, Intel CPUs eventually began adding more cores.

They also increased frequencies to levels suitable for overclocking, but only under stock settings, which undoubtedly had an impact on the Core 13 and Core 14. It also began creating Xeon processors with significantly more cores and performance.

Everything Intel achieved in the processor market was insufficient, as AMD was in charge of outperforming it in both desktop PC processors like the Ryzen, workstation processors like the Ryzen Threadripper, and server and data centre CPUs like the EPYC.

In gaming PCs, the Ryzen X3D outperforms all Intel processors, the Threadripper outperforms most Xeons, and the EPYC has more cores and power. If we combine the losses in IFS and the graphics card market, we get numbers similar to Q2 2025, with massive profit declines.

Now in Q3 2025, revenues reached $13.7 billion, surpassing analysts’ projections of $13.14 billion and representing a 3% increase from $13.3 billion in Q3 2024. The gross profit margin increased by 23.2 points from 15% in Q3 2024 to 38%.

Intel reported a net profit of $4.1 billion, down from a $16.6 billion loss in the same time last year, marking a 124% increase. The operating margin is up 5% from the 68.2% loss in Q3 2024, representing a 73.2-point gain. The tax rate is up 6.6%, compared to an 87% decline last year, reflecting a 93.6-point increase.

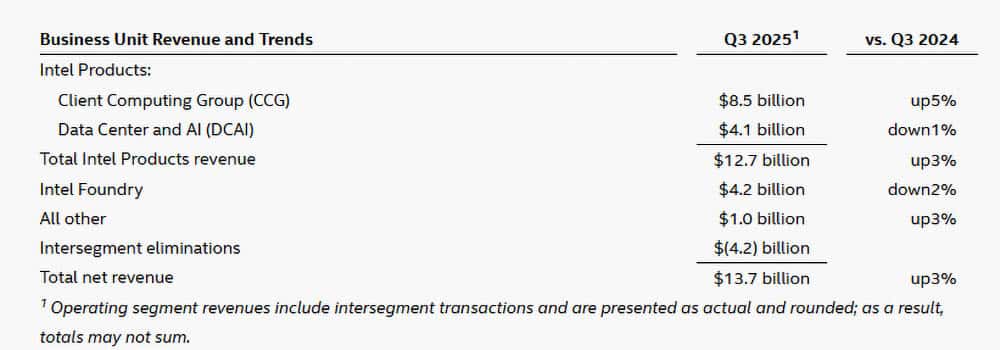

We have diluted earnings of $0.90 per share attributable to Intel, compared to a loss of $3.88 per share a year earlier, representing a 123% year-over-year gain. If we now move on to revenue segmentation, we begin with Intel products, which earned $12.7 billion in total sales, divided into $8.5 billion for CCG (Client Computing Group) and $4.1 billion for DCAI (Data Centres and AI), a 3% increase over Q3 2024.

Intel’s foundry (IFS) has dropped 2%, while the company’s other products have earned $1 billion, a 3% increase. Now that we have the Q3 2025 numbers, Intel is expected to make $12.8 to $13.8 billion in sales and $0.14 per share in Q4 2025.

Thank you! Please share your positive feedback. 🔋

How could we improve this post? Please Help us. 😔

[Editor-in-Chief]

Sajjad Hussain is the Founder and Editor-in-Chief of Tech4Gamers.com. Apart from the Tech and Gaming scene, Sajjad is a Seasonal banker who has delivered multi-million dollar projects as an IT Project Manager and works as a freelancer to provide professional services to corporate giants and emerging startups in the IT space.

Majored in Computer Science

13+ years of Experience as a PC Hardware Reviewer.

8+ years of Experience as an IT Project Manager in the Corporate Sector.

Certified in Google IT Support Specialization.

Admin of PPG, the largest local Community of gamers with 130k+ members.

Sajjad is a passionate and knowledgeable individual with many skills and experience in the tech industry and the gaming community. He is committed to providing honest, in-depth product reviews and analysis and building and maintaining a strong gaming community.