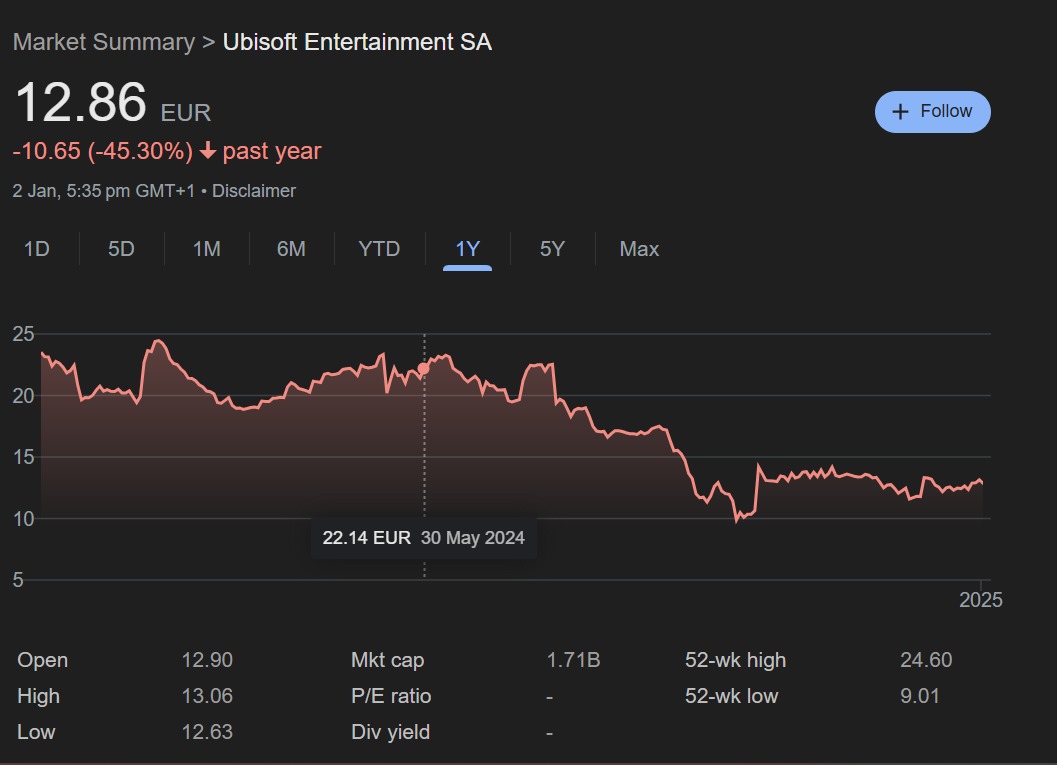

- Ubisoft is experiencing a significant financial downturn, drastically decreasing its stock value.

- Its stock value has gone down by over 45%, which is a new one-year low.

- Experts warn that if upcoming releases, especially Assassin’s Creed Shadows, underperform, Ubisoft could face bankruptcy or be acquired soon.

It’s nothing new that Ubisoft is facing a severe financial crisis at the moment. The new year hasn’t been too kind to the French company, as its stock has plummeted by over 45%, reaching a historic one-year low.

The company’s current financial position is pointing towards a potential bankruptcy this year, or a takeover by Tencent which is heavily rumored.

Why it matters: This one-year low points to bigger problems within the company, such as weak game sales, delayed projects, and internal struggles.

In the past year, Ubisoft’s share price has dropped by over 45%. This sharp decline has raised concerns among investors and analysts, showing a lack of confidence in the company’s future. In 2023, Ubisoft reported a net loss of €494 million, with its share price falling 79.38% over the last five years.

Many of Ubisoft’s recent game releases have not done well, adding to its financial troubles. For example, Star Wars Outlaws didn’t meet sales expectations, forcing the company to lower its fiscal 2025 revenue forecast from €2.3 billion to €1.95 billion.

Additionally, the launch of Assassin’s Creed Shadows was pushed back to February 2025, which caused the stock to plummet even more. On the other hand, Skull and Bones is a disaster, as the game launched to only 400 concurrent players on Steam.

Ubisoft has also struggled with internal issues, such as layoffs and studio closures. In December 2024, the company announced it was shutting down its free-to-play shooter XDefiant.

This led to the closure of its San Francisco and Osaka studios and caused major job losses. These actions seem part of a wider effort to reduce costs amid falling revenues.

In response to the crisis, there have been talks about a possible buyout to make Ubisoft a private company. The Guillemot family, who founded Ubisoft, and Chinese tech company Tencent are exploring their options.

Tencent currently holds over 9% of voting rights, while the Guillemot family owns over 20%.

Meanwhile, Joost van Dreunen, founder of SuperData, warns that Ubisoft could be close to bankruptcy and might be bought by another company as soon as 2025. The company’s market value has dropped significantly, from $12.17 billion in 2021 to just $1.71 billion in January 2025, a decline of 85%.

The next few months will be crucial for Ubisoft as it deals with the financial crisis. Assassin’s Creed Shadows is Ubisoft’s last hope, and if it doesn’t sell well, the company’s future could be in jeopardy.

Do you believe Ubisoft will turn things around, or is it over for the French company? Drop your thoughts in the comments section or join the discussion on the Tech4Gamers forum.

Thank you! Please share your positive feedback. 🔋

How could we improve this post? Please Help us. 😔

Passionate gamer and content creator with vast knowledge of video games, and I enjoy writing content about them. My creativity and ability to think outside the box allow me to approach gaming uniquely. With my dedication to gaming and content creation, I’m constantly exploring new ways to share my passion with others.