- Netflix recently acquired Warner Bros. in a massive $83 billion deal.

- It was initially interested in acquiring EA, but settled for WB and its studios.

- IPs like Dead Space, Battlefield, Mass Effect, and others could’ve belonged to Netflix.

Last Friday, alarm bells started ringing: Netflix announced the purchase of Warner Bros. Discovery, or so we thought, because now Paramount Skydance is trying to derail the deal. That’s right, while Netflix was loudly announcing its acquisition of Warner Bros. Discovery, which also includes the HBO Max platform, it seems its competition isn’t going to sit idly by.

Last night, it was revealed that Paramount Skydance had made a counteroffer to Warner Bros. to thwart Netflix’s acquisition attempt.

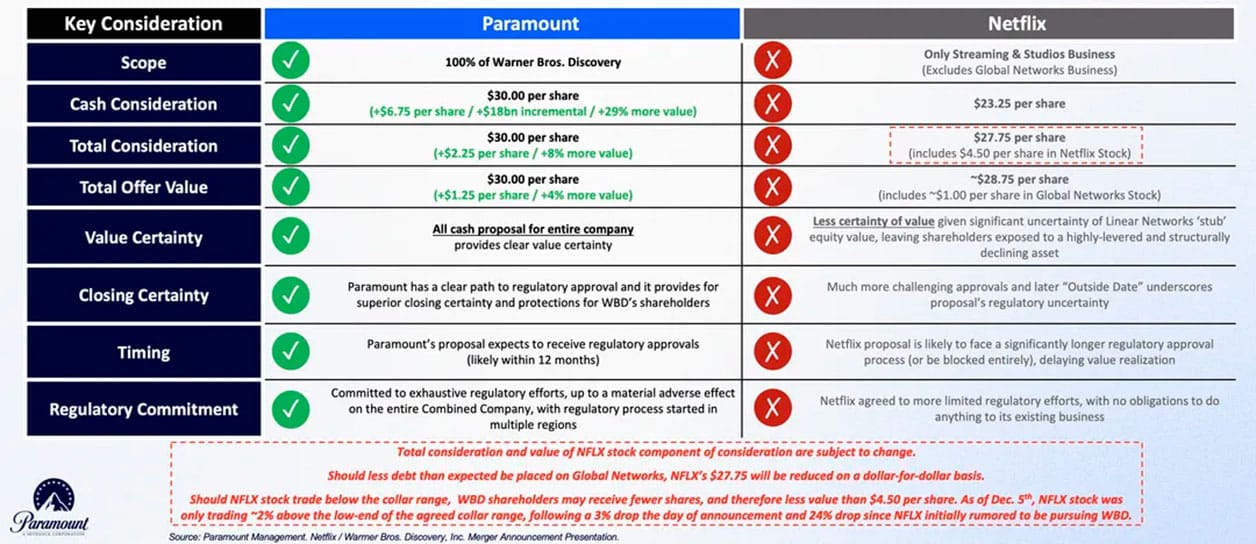

Paramount’s hostile takeover bid involves offering more money, and the best part is that they’re offering immediate cash, unlike Netflix. Furthermore, Paramount maintains that its offer is not only better because it’s more expensive, but also because it has a higher probability of receiving regulatory approval.

Paramount Drops $108.4B Bid, Beating Netflix’s $82.7B For Warner Bros. Discovery

That’s right, Paramount Skydance’s bid has sparked an unprecedented corporate war in Hollywood, pitting Netflix against its former acquisition, Warner Bros. Discovery. Paramount’s offer is $30 per share, paid entirely in cash, and leaves no stone unturned.

It also includes Warner Bros. Discovery’s film and television studios, the Max streaming service, and its linear networks—a portion that Netflix had excluded from its proposal. Netflix, for its part, offered $27.75 per share, with each share to be purchased for $23.25 in cash and the remaining $4.50 in Netflix stock.

This move was announced just three days after Netflix announced its acquisition of Warner Bros. Discovery. But now, Paramount has entered the picture, offering not only more money—all in cash—but also seeking to acquire the entire company.

That’s why Paramount Skydance has gone all out, sending a letter directly to shareholders. In it, they indicated that they are offering a proposal with greater value and security. This proposal eliminates the uncertainty associated with stock-based payments and separates the business units from the rest of the parent company before being absorbed by Netflix.

Paramount Skydance also stated that its complete acquisition structure provides a clearer regulatory path and would allow the transaction to close in approximately 12 months.

Warner Bros. Discovery Confirms It Will Evaluate The Offer

Bad news for Netflix: while the agreement is currently in place, Warner Bros. Discovery has confirmed it will evaluate Paramount Skydance’s acquisition offer. The board will now be forced to review the terms of the acquisition, as the higher-value, all-cash proposal is more beneficial to shareholders.

If Paramount Skydance wins this hostile takeover bid, we would be looking at the future media giant, with studios, streaming services, and traditional television all under one umbrella. However, if Netflix ultimately wins what has become a bidding war, the industry would see a reorganization more focused on digital platforms and major film franchises.

Regardless of who wins the bid, both companies will face intense antitrust scrutiny in the United States and other international markets. Regulators have been warning for years about the risks of excessive concentration in the entertainment industry.

Paramount points out that its offer is more likely to pass these tests. Paramount is not seeking to restructure the company or merge two major streaming platforms, which would eliminate competition and favor a monopoly.

Therefore, Netflix could face regulatory hurdles. The final decision rests with the shareholders, who will decide whether to honor the agreement reached with Netflix or replace it with Paramount’s offer.

Thank you! Please share your positive feedback. 🔋

How could we improve this post? Please Help us. 😔

[Editor-in-Chief]

Sajjad Hussain is the Founder and Editor-in-Chief of Tech4Gamers.com. Apart from the Tech and Gaming scene, Sajjad is a Seasonal banker who has delivered multi-million dollar projects as an IT Project Manager and works as a freelancer to provide professional services to corporate giants and emerging startups in the IT space.

Majored in Computer Science

13+ years of Experience as a PC Hardware Reviewer.

8+ years of Experience as an IT Project Manager in the Corporate Sector.

Certified in Google IT Support Specialization.

Admin of PPG, the largest local Community of gamers with 130k+ members.

Sajjad is a passionate and knowledgeable individual with many skills and experience in the tech industry and the gaming community. He is committed to providing honest, in-depth product reviews and analysis and building and maintaining a strong gaming community.